Few people outside academia realize how badly Randomized Evaluation has polarized academic development economists for and against. My little debate with Sachs seems like gentle whispers by comparison.

Want to understand what’s got some so upset and others true believers? A conference volume has just come out from Brookings. At first glance, this is your typical sleepy conference volume, currently ranked on Amazon at #201,635.

Few people outside academia realize how badly Randomized Evaluation has polarized academic development economists for and against. My little debate with Sachs seems like gentle whispers by comparison.

Want to understand what’s got some so upset and others true believers? A conference volume has just come out from Brookings. At first glance, this is your typical sleepy conference volume, currently ranked on Amazon at #201,635.

But attendees at that conference realized that it was a major showdown between the two sides, and now the volume lays out in plain view the case for the prosecution and the case for the defense of Randomized Evaluation.

OK, self-promotion confession, I am one of the editors of the volume, and was one of the organizers of the conference (both with Jessica Cohen). But the stars of the volume are the speakers and commentators: Nava Ashraf (Harvard Business School), Abhijit Banerjee (MIT), Nancy Birdsall (Center for Global Development), Anne Case (Princeton University), Alaka Halla (Innovations for Poverty Action), Ricardo Hausman (Harvard University), Simon Johnson (MIT), Peter Klenow (Stanford University), Michael Kremer (Harvard), Ross Levine (Brown University), Sendhil Mullainathan (Harvard), Ben Olken (MIT), Lant Pritchett (Harvard), Martin Ravallion (World Bank), Dani Rodrik (Harvard), Paul Romer (Stanford University), and David Weil (Brown). Angus Deaton also gave a major luncheon talk at the conference, which was already committed for publication elsewhere. A previous blog discussed his paper.

Here’s an imagined dialogue between the two sides on Randomized Evaluation (RE) based on this book:

FOR: Amazing RE power lets us identify causal effect of project treatment on the treated.

AGAINST: Congrats on finding the effect on a few hundred people under particular circumstances, too bad it doesn’t apply anywhere else.

FOR: No problem, we can replicate RE to make sure effect applies elsewhere.

AGAINST: Like that’s going to happen. Since when is there any academic incentive to replicate already published results? And how do you ever know when you have enough replications of the right kind? You can’t EVER make a generic “X works” statement for any development intervention X. Why don’t you try some theory about why things work?

FOR: We are now moving in the direction of using RE to test theory about why people behave the way they do.

AGAINST: I think we might be converging on that one. But your advertising has not yet got the message, like the JPAL ad on “best buys on the Millennium Development Goals.”

FOR: Well, at least it’s better than your crappy macro regressions that never resolve what causes what, and where even the correlations are suspect because of data mining.

AGAINST: OK, you drew some blood with that one. But you are not so holy on data mining either, because you can pick and choose after the research is finished whatever sub-samples give you results, and there is also publication bias that shows positive results but not zero results.

FOR: OK we admit we shouldn’t do that, and we should enter all REs into a registry including those with no results.

AGAINST: Good luck with that. By the way, even if do you show something “works,” is that enough to get it adopted by politicians and implemented by bureaucrats?

FOR: But voters will want to support politicians who do things that work based on rigorous evidence.

AGAINST: Now you seem naïve about voters as well as politicians. Please be clear: do RE-guided economists know something the local people do not know, or do they have different values on what is good for them? What about tacit knowledge that cannot be tested by RE? Why has RE hardly ever been used for policymaking in developed countries?

FOR: You can take as many potshots as you want, at the end we are producing solid evidence that convinces many people involved in aid.

AGAINST: Well, at least we agree on the on the much larger question of what is not respectable evidence, namely, most of what is currently relied on in development policy discussions. Compared to the evidence-free majority, what unites us is larger than what divides us.

You are connected by “Six Degrees of Separation” to almost everyone. This surprising amount of connectedness was brought home to me when I realized that I knew a person who knew Lady Gaga (One Degree of Separation). The connection had nothing at all to do with my career or that of Stefani Germanotta, but only with our respective networks of family and friends.

Economists have gotten as excited as anyone else by social networks. A previous blog post talked about intra-ethnic-group networks that are useful for enforcing contracts and deterring cheating. Another important social network function is spreading information. A paper forthcoming in the American Economic Review by Tim Conley and Chris Udry describes how Ghanaian farmers were more likely to succeed at growing pineapples for export the more successful were neighbors already growing pineapples. Pineapple growing is very sensitive to having too much or too little fertilizer, so it was useful that farmers could adapt their fertilizer use based on what had worked for their neighbors.

You are connected by “Six Degrees of Separation” to almost everyone. This surprising amount of connectedness was brought home to me when I realized that I knew a person who knew Lady Gaga (One Degree of Separation). The connection had nothing at all to do with my career or that of Stefani Germanotta, but only with our respective networks of family and friends.

Economists have gotten as excited as anyone else by social networks. A previous blog post talked about intra-ethnic-group networks that are useful for enforcing contracts and deterring cheating. Another important social network function is spreading information. A paper forthcoming in the American Economic Review by Tim Conley and Chris Udry describes how Ghanaian farmers were more likely to succeed at growing pineapples for export the more successful were neighbors already growing pineapples. Pineapple growing is very sensitive to having too much or too little fertilizer, so it was useful that farmers could adapt their fertilizer use based on what had worked for their neighbors.

From Aid to Equality

From Aid to Equality

When Jacqueline Novogratz, founder of the Acumen Fund, was in her early twenties, she turned down a promotion on Wall Street and went to the Cote d’Ivoire to open a new branch of the African Development Bank focused on microfinance for women. But the West African women she was supposed to work with shunned her. They talked about her derisively in her presence, letting her know exactly what they thought of an untested, unmarried, American woman with poor French skills being sent to lead them. They intimidated her, locked her out of the office, and (Novogratz suspects) actually gave her food poisoning to scare her away. It worked.

On her next assignment, in Nairobi, she spent hundreds of hours analyzing the loan portfolio of a young microfinance organization. Presenting her results, she recommended a drastic restructuring. A week later, she found her handwritten report had been “lost,” and all her work destroyed.

When Jacqueline Novogratz, founder of the Acumen Fund, was in her early twenties, she turned down a promotion on Wall Street and went to the Cote d’Ivoire to open a new branch of the African Development Bank focused on microfinance for women. But the West African women she was supposed to work with shunned her. They talked about her derisively in her presence, letting her know exactly what they thought of an untested, unmarried, American woman with poor French skills being sent to lead them. They intimidated her, locked her out of the office, and (Novogratz suspects) actually gave her food poisoning to scare her away. It worked.

On her next assignment, in Nairobi, she spent hundreds of hours analyzing the loan portfolio of a young microfinance organization. Presenting her results, she recommended a drastic restructuring. A week later, she found her handwritten report had been “lost,” and all her work destroyed.

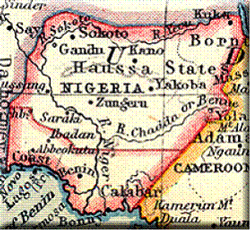

In colonial Nigeria in the last years of the 19th century, a strange quirk of history led the British rulers to draw an arbitrary boundary line along the 7˚10' N line of latitude, separating the population into two separate administrative districts.

In colonial Nigeria in the last years of the 19th century, a strange quirk of history led the British rulers to draw an arbitrary boundary line along the 7˚10' N line of latitude, separating the population into two separate administrative districts.